Market insights

I remember my childhood family trips usually involving long car drives. My parents occupied the front seats and, more often than not, me or one of my siblings would squeeze forward to ask the unequivocal question: Are we nearly there yet? Whether this was motivated out of boredom, hunger or pure excitement to get to our destination as soon as possible, we always looked forward to the journey ending. Well, over the last few weeks, I feel like I have gone back in time, as I keep asking myself this very same question, only to realise that there is nobody in the driver’s seat to answer me.

December delivered on the infamous ‘Santa Claus Rally’ in a way that absolutely nobody could have imagined, given that it followed the worst pre-Christmas trading session in the US markets EVER. The rally started with a bang, claiming the highest one-day climb the Dow Jones had ever seen (1’086 points) and the largest one-day percentage rise for the Dow Jones, S&P500 and Nasdaq since March of 2009. It was the perfect ending to a year that broke record after record and caught investors shorthanded more than once.

Back to that question, which my parents sometimes reluctantly answered, and I have found myself thinking about of late. Far from being alone in my thoughts, investors all over are asking themselves similar questions as they look at the behaviour of asset prices and at how risks are being priced in the markets. Is this the bottom? When are we going to start seeing the market recover? Is it time to buy again? I now understand my parents better. I feel their pain.

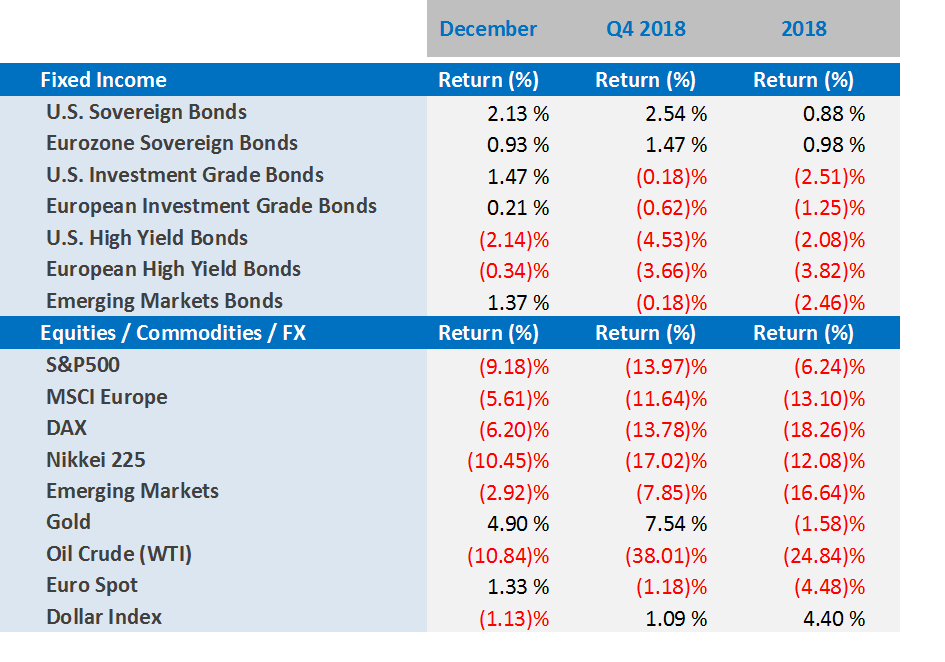

Looking at the market’s performance in December, it was a textbook ending to an eventful and volatile year. As investors shunned risky assets, global equities and credit markets suffered strong losses, whilst gold, sovereign grade bonds and investment grade bonds were well supported by investors.

- Developed market equities had a very negative month, with major indexes experiencing intra-month losses greater than 10% in the US, Europe and Japan. Investors faced a strong wave of negative news related to the US, ranging from: the Federal Reserve raising rates (despite the recent downward revision of US economic growth) and political noise coming from the White House (with President Trump saying he was prepared for a “long government shutdown”) to a lack of positive news related to the trade war between the US and China. As a result, the global market rout was led by the US, which came extremely close to a bear market at the end of the pre-Christmas trading day. At the end of the month, the S&P500 lost 9.18% in the United States, the MSCI Europe fell 5.61% and in Japan, the Nikkei 225 fell 10.45%.

- Fixed income markets had another mixed month, with safe havens, once again, strongly outperforming riskier assets both in the US and Europe, as investors ran for safety while losses were mounting elsewhere. US Treasuries gained 2.13%, US investment grade bonds gained 1.47%, while US high yield bonds ended the month down 2.14%. In Europe, sovereign bonds gained 0.93%, investment grade bonds gained 0.21%, while European high yield bonds fell 0.34%.

- Emerging markets gave us a positive surprise, despite the almost panic selling of US equities in the second half of the month. A weaker dollar and increased credit spreads, as a result of the fall in US Treasury yields, were the incentives investors were waiting for to return to emerging market bonds. Meanwhile, strong positive sentiment in Mexico and Brazil helped to soothe equity investors, with emerging market equities outperforming developed country equities by a large margin. EM equities lost 2.92%, and EM bonds gained 1.37%.

- Oil markets kept their strong negative momentum of the previous month and ended December down 10.84%. Prices dropped sharply as a result of the lack of coordination and political motivation from both OPEC members and Russia to agree on big-enough cuts in oil production, in addition to the pressure caused by oversupply in the US, topped off by the risk of lower demand globally (due slowed economic growth) . The result being that oil was down 38.01% last quarter, bringing 2018’s accumulated negative performance to -24.84%.

- Gold had a very strong month, gaining 4.90% in December, as investors looked for safety and sold riskier assets that were in free-fall during the month. The yellow metal had an impressive run in the last quarter of the year, jumping 7.54% and recovering most of the losses of 2018, closing the year down -1.58%.

Global markets in numbers

Market Outlook and V3´s position

2018 was one hell of a ride, no matter whether you followed safe havens or equities and December was the epitome of the whole journey. It is refreshing, to say the least, to see how heroes can be made or destroyed in just a couple of weeks. How a losing strategy can beat its benchmark and peers by sticking to its guns until the last minute, while ‘lazy’ champions can be eaten by the markets in a heartbeat as investors have a change of mind and the stars align.

December saw the Federal Reserve raise rates in the midst of a US economic growth slowdown at the same time as the White House decided it was ok to have a government shutdown to push for funding for the infamous border wall. This was all while fighting a trade war with China. The icing on the cake was US Treasury Secretary Mnuchin’s idea to announce that he had a call with all major US banks to confirm that they were well capitalized and that he would be meeting with the Working Group on Financial Markets (which also convened during the 2008 financial crisis) despite the fact that the US was “maintaining a strong economic growth”. Me think he doth protest too much. And investors agreed, puzzled by Mnuchin’s unrequired assurance on the state of the US economy and its financial markets, they responded by delivering the worst pre-Christmas trading day in the history of US equity markets… but would that mark the bottom of this latest market collapse?

That brings us to the incredible Santa-Claus rally of 2018 and predictions for 2019. Surprisingly, the end of the year allowed everyone to save face and claim victory, despite the huge losses that market inflicted on investors. Bears confirmed their position as markets experience the worst yearly result for US equities since the financial crisis of 2008. Meanwhile bulls enjoyed their Santa-Claus rally and the expectation that 2019, thanks to the 5-day rule, will follow the suit and deliver a positive result by year end.

That leads us to our outlook for 2019. What should we expect after all we have been through in the past few weeks and months? To begin with, we do not believe that the current array of risks will fade anytime soon, or even disappear. By way of example, let’s look at the most apparent risk: that of the trade war between the US and China. Whilst this might not be moving on to the next level for now, the antagonism between both countries will only increase. The pressure to contain China’s explosive technological growth will likely not yield real positive results and the only way out will be an agreement that neither will fully adhere to. The fact that the US is not the sole global power anymore (both in the economic and military sense), brings all kinds of geopolitical and market uncertainties. Although we do not expect a US-China ‘cold war’, both titans are likely to clash more often thereby affecting the markets. This alone should cast a shadow over any positive outcomes of the current trade talks.

We do believe that the global economy will continue to decelerate in 2019, with the US, EU and China all contributing to this slowdown in economic growth. Nevertheless, we are not forecasting a recession in the US, or any kind of hard-landing in the Chinese economy, despite the effects of the trade war with the US. That means that our base-scenario still calls for interest rates in the US to be raised, which will in turn keep equity markets on edge. However, we do see equity valuations somewhat attractive at current levels, resulting in a good entry point for long-term investors looking to start, or resume, building positions, regardless of any weakness that we might experience during 2019.

We remain neutral in our equity allocation, with the view that European equities have better prospects than those in the US, as valuations in the continent are more attractive than those from across the Atlantic. Elsewhere, we remain optimistic about selected emerging markets, both local and in US Dollar, as local dynamics overshadow major global trends in countries like Brazil and Mexico. Fixed income investors might avoid sovereign bonds after their strong performance late last year, as premiums are practically non-existent, except if used to hedge against unlikely scenarios, such as a US recession or the worsening of the US-China trade war. Credit markets will have another difficult year in 2019, but could outperform cash and exhibit positive returns based on a good bond selection. That means that, as was the case for 2018, active portfolio management will be essential for a bond selection to yield positive results once again.

As was also the case for 2018, we are not running for the exit like there is no tomorrow, but we do acknowledge that we must remain vigilant to the various risks surrounding us. We believe that there is a possibility that the December 24th low was the near-term bottom that investors were looking for before returning to invest in equities. But, as we saw for most of last year, we do expect volatility to remain elevated and markets to be extremely sensitive to bad news. We need to make sure portfolios are well diversified and balanced in order to withstand any renewed wave of pessimism, as well as to take advantage of any upside that might occur in the near future.

Are we nearly there yet, you may ask… well, we might well be, but we are definitely not out of the woods and caution could well be the motto of the year.

For more information, please contact our Chief Investment Officer, Cássio H. Valdujo, on:

+41 22 715 0910

cassio.valdujo@v3cap.com

Cover image: https://www.shutterstock.com/image-photo/sad-little-kid-boy-sitting-car-472521127