Market insights

It is rightly said that life is made of choices. Indeed, we are always making them…some subconsciously, others after careful consideration and a few without any care at all. In asset management we are constantly under pressure to make decisions, often in a very short timeframe and with important consequences on the up and downside.

Sometimes the choice is a simple one, between a good and a bad option. On occasion, we are given ‘nice problems’, which offer us two or more positive options to choose from. A rare joy to decide. The issues start when our choices are between a number of equally bad outcomes, ie: when we need to decide between something bad and something potentially worse.

A good example of a bad problem comes in the form of Brexit. Regrettably this has become something of a soap opera, with the British government fighting to implement its negotiated agreement with the EU, only to be defeated multiple times in Parliament, more often than not by a shamefully high margin. On top of which, every single alternative Brexit proposal put forward to Parliament has failed to win a majority vote. This shows us just how difficult it can be to make a decision when the perfect outcome simply does not exist. In the end, no matter how things evolve, it will be the least bad option which will most likely be chosen, though after a lot of compromise from all sides.

Mapping the possible consequences of a choice we are facing is the first step in the decision process we all go through. Things start to get more complex when either we cannot foresee the possible consequences, or when those are unpredictable. How can we decide between two unknowns?

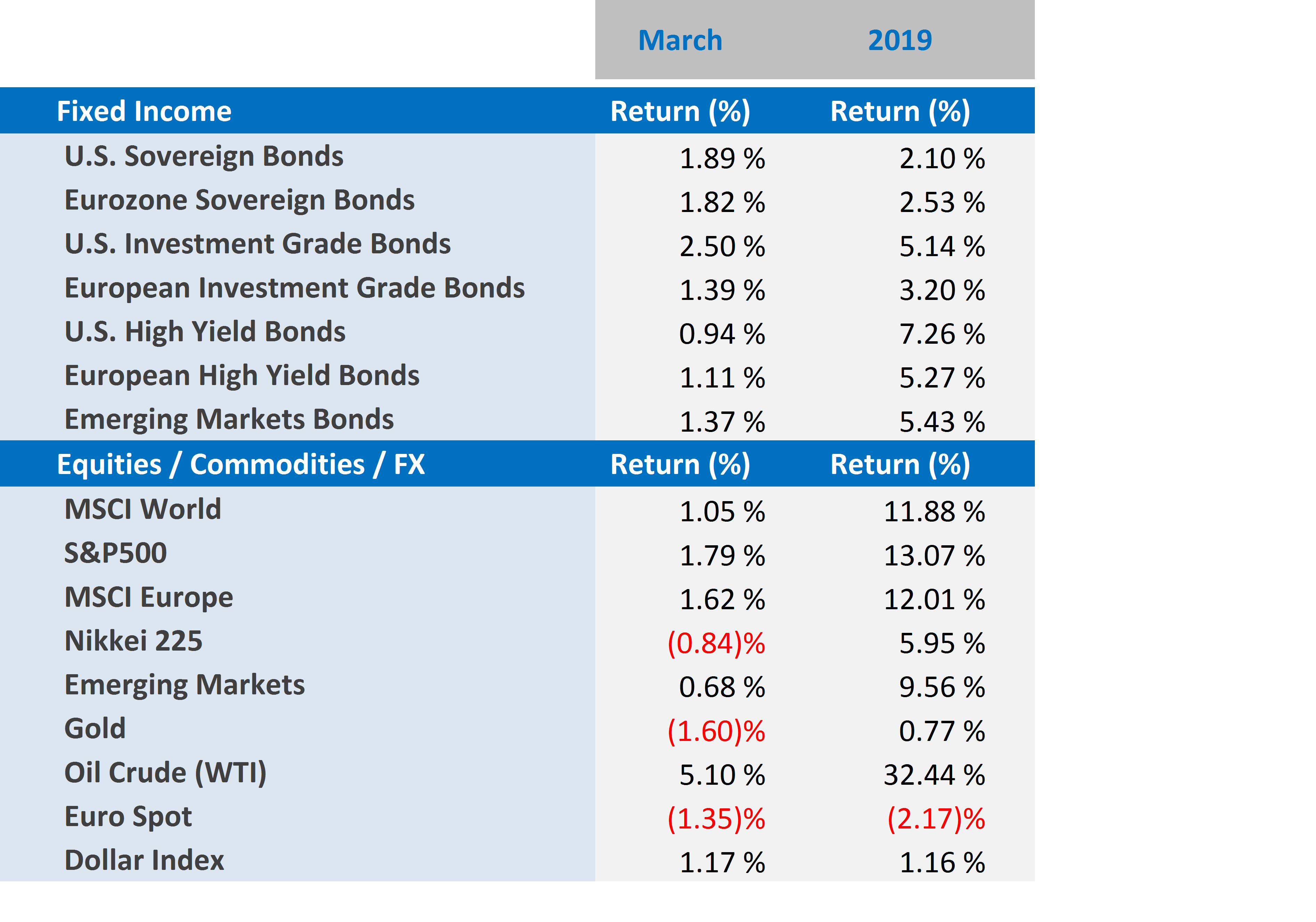

Before I delve further into the unknown, let’s have a look at what has been going on in the markets in March:

- Developed market equities had a mostly positive month (the third in a row) and had their largest quarterly gain since Q3 2010, which was mainly driven by the US. Positive catalysts were plentiful and included: a pause in the interest rate hike cycle in the US, a possible breakthrough in the US-China trade talks, as well as renewed positive sentiment towards the tech sector and other growth stocks globally. In the UK and Europe, any optimistic news was lost next to the all-consuming Brexit discussions. The S&P500 gained 1.79% in the United States and the MSCI Europe gained 1.62%, while in Japan, the Nikkei 225 lost 0.84% as a result of news of negative corporate earnings growth in the country’s manufacturing sector.

- Fixed income markets had another strong month, with all sectors showing gains in response to both the pause in the US interest rate hike cycle and the stimulus measures adopted by the ECB in Europe. US Treasuries gained 1.89%, US investment grade bonds gained 2.50% and US high yield bonds ended the month up 0.94%. In Europe, sovereign bonds gained 1.82%, investment grade bonds gained 1.39% and European high yield bonds gained 1.11%.

- Emerging markets had another positive month, helped once again by the persistent risk-on sentiment in the markets, despite the stronger US Dollar. EM equities gained 0.68%, and EM bonds gained 1.37%.

- Oil kept its positive momentum and had another positive month, gaining 5.10%. Once again, the market was supported by lower output from OPEC countries and Russia, which has kept global supplies in check and tilted the balance in favour of producers.

- Gold had another negative month, losing 1.60%, as a result of the strong US dollar. This was despite moves by central banks in the US and Europe to stimulate, or at least not to decelerate, the economy.

Global markets in numbers

Market Outlook and V3´s position

Looking at what has been going on in the markets recently, it is easy to understand why I am talking about choices and the unknown. After an incredible first quarter, global equities are up almost 15%, with some indexes, such as the Chinese CSI 300 up more than 30% so far this year. Where can markets go from here? Can they keep climbing despite the risks to the global economy that prompted the US Federal Reserve and the ECB in Europe to respectively halt the tightening of financial conditions and to further stimulate the economy last month? What about fixed income markets? A warning signal started flashing when the difference between the 3-month rate and the 10-year rate in the US reached negative territory for the first time since 2007, indicating that the risk of a US recession is growing. In light of all this, are the recent market moves sustainable?

It is easy to decide what to do with your portfolio if you know the answer to these questions. You stay invested in risky assets if you believe that markets will keep going up. If your market views are not that rosy, you can trim your risk exposure, take some profits and wait for the market to correct before you go back to them full throttle. When we can only guess the future (however educated and well-reasoned this may be), the consequences have the potential to be devastating if what you expect to happen does not materialise. It is the risk of choosing between two unknowns.

The ‘best’ solution to this conundrum, in our view, is a tamed approach to risk taking, via the active management of a well-balanced portfolio - one which can take advantage of a strong market but defend in case of a correction. That is why we continue to insist on ensuring investors know their portfolios’ strengths and weaknesses well, before the storm arrives. In times of uncertainty, it is important not to be taken by surprise by an unexpected high correlation between seemingly uncorrelated holdings, or by the extreme illiquidity of a theoretically liquid investment. For now, we have decided to keep our neutral stance in equities and our positive view in select emerging markets. We are certainly not passively waiting for something to happen before it is too late. That is why we continue to favour liquid investment strategies in all asset classes, to ensure we will be able to change our allocation, with the minimum cost, if and when the time for change comes.

We chose safety above risk, at least for now.

For more information, please contact our Chief Investment Officer, Cássio H. Valdujo, on:

+41 22 715 0910

cassio.valdujo@v3cap.com

Cover image: https://www.shutterstock.com/image-photo/school-boy-sitting-front-hard-choice-567048925