Market insights

July marked the beginning of the holiday season. Given how empty the city was, I know I was not alone in heading beachside, where I celebrated my son’s third birthday. It was great to see his excitement build, culminating in that one special day, where he was the centre of attention and apparently the owner of a toy shop, given the number of gifts he received.

Have you ever seen a child open a present? It bears an uncanny similarity to how investors reacted to the long-awaited cut in interest rates.The initial joy at getting a much anticipated Fisher-Price Think & Learn Teach 'n Tag Movi (yes, that is a ‘thing’), or a reduction in US interest rates for the first time in more than a decade, is quickly forgotten as sights are recalibrated and set on the next target (more interest rates cuts please).

The momentous lowering of Fed Funds from 2.25% to 2% was met with a ‘meh’ reaction from the markets. This surprising response was less astonishing when we look at market behaviour in the run up to the announcement. Over expectation at what was to come led to markets over-excitedly pricing a better-than-best-case scenario cycle of interest rate cuts, demonstrated by the yield of 2-year US Treasury notes being a staggering 50 basis points below Fed Funds. The anticipation was out of whack with the announcement itself, leaving investors with arms outstretched asking for their next gift.

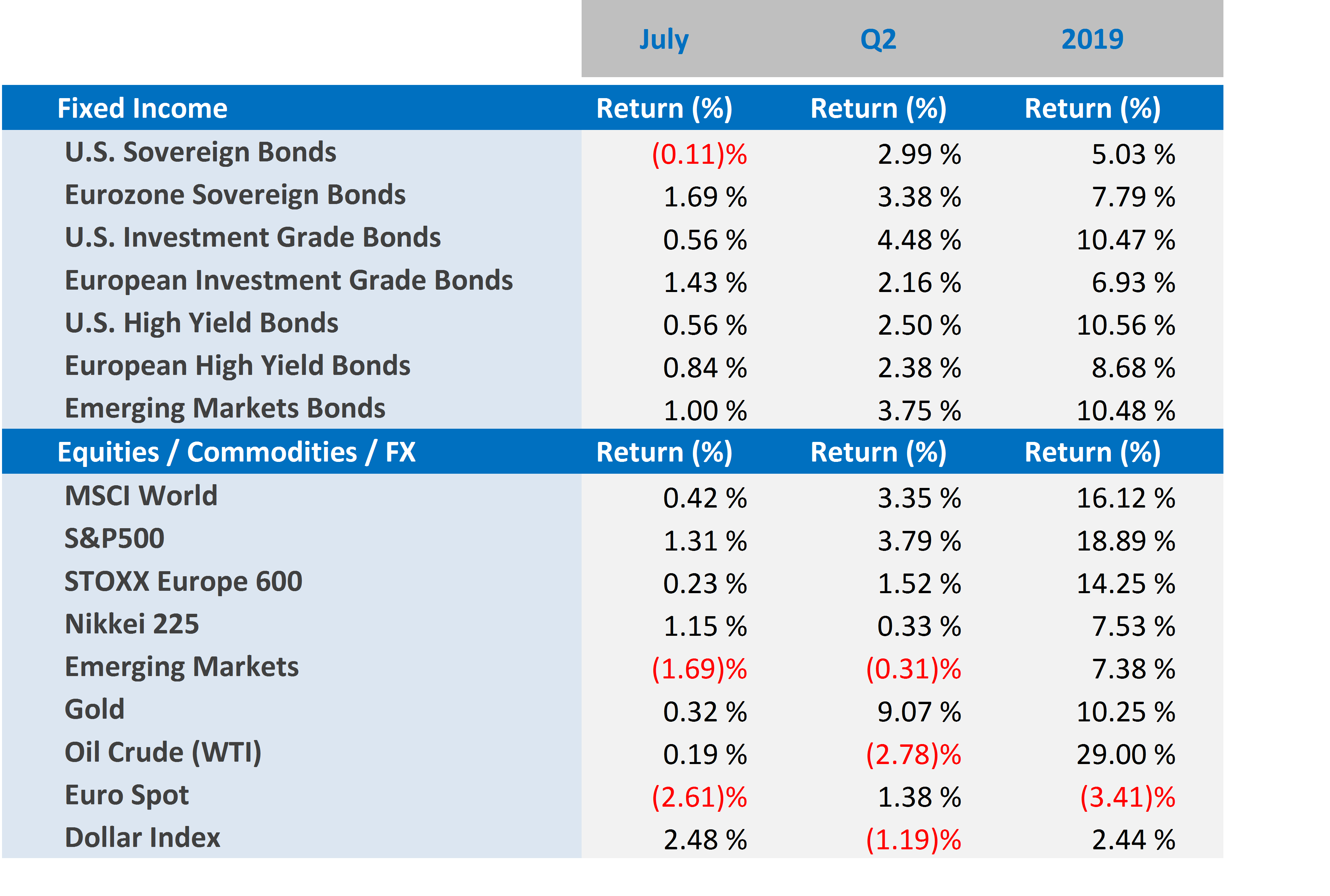

Market performance of the main asset classes last month was clearly driven by hype leading up to the US Federal Reserve’s meeting on 31st July. Equities were the exception, having a less than stellar time thanks to the lingering weight of the trade war between China and the US, which only added to the underwhelmed reaction to the interest rate cut in the US:

- Developed market equities made modest gains after June’s strong rebound, as investors waited for the US Federal Reserve bank to cut interest rates in response to uncertainties generated by the trade war between China and the US and the somewhat soft macroeconomic data in the US, pointing to an ongoing economic deceleration. The results: the S&P500 gained 1.31% in the United States and the STOXX Europe 600 gained 0.23%, while in Japan, the Nikkei 225 gained 1.15%.

- Fixed income markets had a mostly positive month, as central banks around the globe once again eased monetary conditions (or pledged to) to foster stronger economic activity. US Treasuries lost 0.11% giving up part of the steep gains of the previous month, while US investment grade bonds gained 0.56% and US high yield bonds ended the month up 0.56%. In Europe, sovereign bonds gained 1.69%, investment grade bonds gained 1.43% and European high yield bonds gained 0.84%.

- Emerging markets had a mixed month, with gains in bonds supported by: the cut in interest rates in the US; lower yields elsewhere; and losses in equities (as global economic growth concerns dented investor confidence). EM equities lost 1.69%, while EM bonds gained 1.00%.

- Oil prices remained stable, up by 0.19% in July as heightened tensions in the Middle East between the US and Iran were counterbalanced by concerns that the trade war between China and the US will hurt global growth and lower the demand for the commodity.

- Gold had a breather month after June’s steep gains, rising by 0.32%. Demand for the yellow metal could remain elevated for now due to the elevated geopolitical tension in the Middle East and the prospect of lower interest rates in the US and elsewhere which could support the rise of inflation globally.

Global markets in numbers

Market Outlook and V3´s position

Our continued drive for more has been behind incredible achievements. In the month that marked the 50th anniversary of the first lunar landing by the Apollo 11 crew, reflecting on how much the world has changed since then gives us an idea of what we can accomplish by ‘wanting more’. The problem starts when you combine this never-ending hunger with a system that facilitates it as an over-protective parent might: ensuring their coddled, spoilt child does not have to deal with adversities and disappointments.

Central banks have, in most cases, a very specific mandate: to dictate monetary policy so that particular targets can be met. These may include inflation, unemployment rates or forex exchange stability - always with the bigger, unspoken goal of supporting long-term economic prosperity. In theory, central banks are independent and, as such, their decision making is isolated from political motivation and short-term gains. In the past years, however, we have seen central banks running to the rescue of markets with the excuse that when the market is bearish, it negatively affects investor sentiment with a knock-on effect on consumer spending and the economy as a whole. Of course, the reality is a little more complex than that. Take a look at what is happening in the US, where president Trump is viciously attacking the Federal Reserve for its interest rate decisions. It is apparent that behind his excuses to demand a big rate cut (which in theory he has no powers over), lies his own agenda to be re-elected.

In summary, what we are experiencing today (and in fact for the better part of the past decade), is that investors have become used to central banks coming to the markets’ rescue. If that is not a moral failure on the part of central banks, I think we are flying pretty close to one. This behaviour is fuelling a reckless approach to investing. The more risk ‘I’ take, the more ‘I’ rely on monetary authorities to stabilise markets and the more markets pressure them to do so. This creates a vicious cycle that is difficult to get out of and ever more costly to break after each averted crisis and after each missed opportunity to deleverage investors and balance sheets - potentially brewing a new seismic financial crisis in the future.

As we mentioned in previous months, here at V3, we are pressing ahead with lowering our risk exposure. We executed some sector rotation in the previous months, and as the S&P500 reached record highs at the end of July, we took the opportunity to hedge part of the exposure to this asset class (buying Put options whilst volatility was subdued and prices seemed compelling). For now, we are happy with the exposure we have, which will keep most of the upside of a potential market rally fuelled by lower interest rates, at the same time as protecting our portfolios against any market correction that might occur in the near future. As investors never seem satisfied with what they get from central banks, we expect more calls for rate cuts and, in the absence of a positive response from policymakers, we are ready to reap the gains from our hedges. For the time being we are happy to play with our Fisher-Price Think & Learn Teach 'n Tag Movi.

For more information, please contact our Chief Investment Officer, Cássio H. Valdujo, on:

+41 22 715 0910

cassio.valdujo@v3cap.com

Cover image: https://www.shutterstock.com/image-photo/give-me-more-motivation-chalkboard-megaphone-233849815